Muhamad Yehia

US President Donald Trump signed a Presidential memo on reciprocal tariffs to order his administration to investigate the plan, offering time for negotiations. Global markets turned to a risk-on mode following the decision.

On Thursday, Trump directed the US Trade Representative and Commerce secretary to investigate the proposed reciprocal tariffs.

The investigation will include other nations’ levies on US goods and non-tariff barriers such as unfair subsidies, value-added taxes (VAT), and exchange rates. Howard Lutnick, the head of the Commerce Department, said that the study should be complete by 1 April, meaning the White House could act immediately thereafter. The sweeping tariffs are set to be the toughest action of the Trump administration following the 25% levy on steel and aluminium, and an additional 10% tariff on China.

“They charge us a tax or tariff and we charge them the exact same,” Trump said in a press conference in the Oval Office, “Nobody knows what that number is unless you go by country.” He also mentioned that tariffs on autos, computer chips and pharmaceuticals would be charged for higher rates, which would be “over and above” the reciprocal tariffs

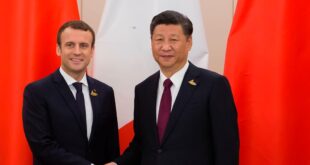

Challenges for the EU

The European Union’s VAT is expected to be particularly targeted in the White House’s studies. Trump has repeatedly complained about the unfair trading relationship between the EU and the US. In 2024, the value of goods traded between the two parties amounted to $1.3 trillion (€1.24 trillion), with the deficit for America recorded at $267 billion (€255 billion), according to the US Census Bureau. However, the EU noted previously that the bloc imports more services fr

Once implemented, the European pharmaceutical sector will be hardest hit by the reciprocal tariffs. According to the US Trade Census, the US imported $127 billion (€121.4 billion) worth of pharmaceutical products in 2024. The GLP-1 weight-loss drugs accounted for a major percentage of imports from the EU to the US, where Novo Nordisk’s Wegovy held a significant market share.

In addition, European-made vehicles will also be heavily impacted, as the White House cited unfair trade and tax practices between the two economies. Trump also called for the EU to purchase American ammunition to maintain the NATO alliance

European markets surge to new highs

Trump’s delay in imposing reciprocal tariffs, alongside a Trump-Putin talk aiming to end the Ukraine war, propelled European stock markets to become the top performers again among the world’s major exchanges. On Thursday, the Euro Stoxx 600 surged 1.1% and Germany’s DAX leaped more than 2% to their new record highs. Both the euro and the British Pound jumped against the dollar amid a potential end of a three-year military war between Russia and Ukraine. However, European leaders from Britain, France, and Germany stated that they must be part of any future negotiations.

“While the markets remain on a tightrope when it comes to both issues, the Trump administration’s approach so far has been relatively measured and leaves scope for negotiations, lowering the prospect of tit-for-tat, race to the bottom dynamic emerging,” Kyle Rodd, a senior market analyst at Compital.com, wrote in an email.

On Wall Street, three benchmark indices-the Dow Jones Industrial Average, the S&P 500, and the Nasdaq, all finished higher. The US dollar index weakened following a decline in the US government bond yields, pushing up metal prices. Gold prices continued to rise after a brief one-day retreat, nearing their all-time highs two days ago.

موقع وجه أفريقيا موقع وجه أفريقيا هو موقع مهتم بمتابعة التطورات في القارة الأفريقية

موقع وجه أفريقيا موقع وجه أفريقيا هو موقع مهتم بمتابعة التطورات في القارة الأفريقية