Muhamad Yehia

President Donald Trump’s comments have raised hopes of a de-escalation in the trade war between the world’s two largest economies. This has further strengthened the Chinese currency and stock markets, which have gained throughout the month amid the surprising launch of DeepSeek’s AI model.

US President Donald Trump told reporters that a trade deal with China “is possible” in an interview aboard Air Force One.

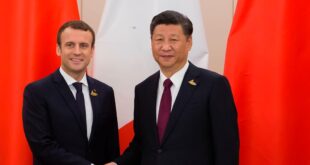

He said he has “a great relationship” with Chinese President Xi Jinping: “But remember, he loves China, and I love the USA. So you know, right there, there is a little bit of competitiveness, but the relationship I have with President Xi is, I would say, a great one.”

He also mentioned that he had previously made a trade deal with China during his first term: “We did a great deal with China, we did great for the farmers, great for the manufacturers,” referring to the Phase One trade deal that the US and China signed in 2020. “They had about $50 billion worth of our product, and we were making them buy it. The problem is that Biden didn’t push them to adhere to it,” he added.

No further escalation in the US-China trade war

Trump imposed an additional 10% tariff on Chinese imports at the beginning of the month. Two days later, China’s State Council Tariff Commission announced that it would impose a 15% levy on coal and liquefied natural gas (LNG) from the US, as well as a 10% duty on American crude oil, farm equipment, and certain vehicles, effective from 10 February

According to a report from The Wall Street Journal, China’s initial proposal in response to Trump’s fresh tariffs was to restore the Phase One trade deal. Other proposed measures included a pledge not to devalue the Chinese Yuan and a commitment to reducing exports of fentanyl precursors.

There has been no further escalation since then, although the US president signalled that any retaliation from countries impacted by US tariffs could lead to an increase in, or expansion of, their export costs. He paused the planned 25% blanket tariff on Mexico and Canada after the two countries agreed to tighten border controls to combat drug trafficking, particularly fentanyl.

Chinese Yuan and stock markets gain

The Chinese Yuan strengthened sharply against the US dollar on Thursday, partially boosted by Trump’s comments on the trade deal. The USD/CNH exchange rate -measuring the dollar against the Chinese offshore Yuan – fell 0.65% to its lowest level since November 2024, after briefly touching this level on 24 January

Chinese stock markets also climbed following the news on Thursday, with the Hang Seng Index (HSI) paring earlier losses on the day, ending 1.6% lower, but remaining at a more-than four-month high. The index jumped 2% at the open at the Hong Kong Stock Exchange in Friday’s Asian session, also boosted by positive earnings from Alibaba.

The Chinese e-commerce giant exceeded expectations in its quarterly earnings, with the company’s AI-backed cloud business achieving its fastest growth in two years. Alibaba’s shares surged 15% to a three-year high before paring gains in US trading on Thursday

The HSI is the Chinese benchmark that was heavily weighed by Chinese leading tech companies, including WeChat owner Tencent Holdings, Jack Ma-founded Alibaba Group, Apple’s Chinese rival Xiaomi, and Tesla’s competitor BYD.

Both the Chinese Yuan and the Chinese stock markets have been on the rise since the Chinese startup DeepSeek unveiled an artificial intelligence model, R1, in late January. The model is a direct competitor to OpenAI’s ChatGDP. Earlier this month, China’s largest electric vehicle maker, BYD, announced its plan to integrate DeepSeek’s AI model into its operations, pushing its share price to an all-time high.

موقع وجه أفريقيا موقع وجه أفريقيا هو موقع مهتم بمتابعة التطورات في القارة الأفريقية

موقع وجه أفريقيا موقع وجه أفريقيا هو موقع مهتم بمتابعة التطورات في القارة الأفريقية